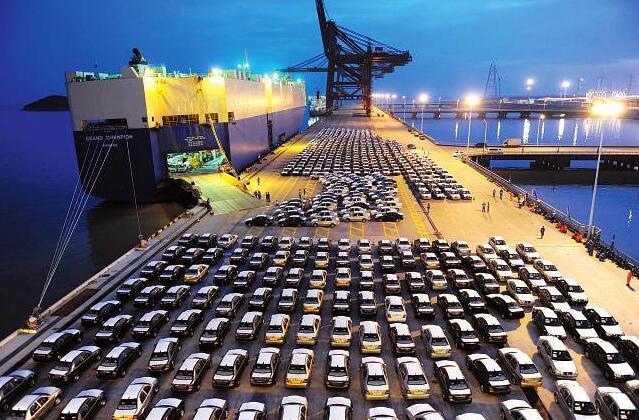

In 2023, the new energy passenger vehicle market as a whole exhibited a trend of gradually slowing growth, while export growth remained strong. Both automakers and lithium battery manufacturers are actively devising strategies to cope with the complex and volatile production and sales trends in the new energy vehicle market. In addition to aggressively capturing market share domestically, "going global" has become a "must" for companies across the industry.

As of June 15, among the 50 battery gigafactory projects announced in the European Union, Chinese battery companies accounted for more than half. Regarding overseas capacity deployment, China has already established 25 manufacturing projects abroad, with planned total capacity exceeding 500 GWh.

According to observations by the Securities Daily reporter, since 2023, Chinese battery companies including Envision Power, XTC New Energy, Eve Energy, Putailai, Sunwoda, and Longpan Technology have announced the establishment of subsidiaries and capacity expansions in Europe and Southeast Asia, aiming to get closer to customers through localized production and seize the rapid development opportunities in the global industry.

"Domestic power battery companies have entered a state of intense domestic competition, while overseas markets remain a blue ocean. Therefore, we are going abroad to exchange technology for market access," said Zhang Xiaocong, Vice President of Marketing at REPT Power & Energy Co., Ltd. He believes that today's Chinese battery manufacturers are entering overseas markets with leading technology, much like global automotive giants such as Volkswagen and General Motors did 30 years ago.

Gao Yunpeng, council member of the China New Energy Industry Innovation Alliance, told the Securities Daily that Europe has the most aggressive timeline for banning internal combustion engine (ICE) vehicles. The EU aims for 2035, while the UK and Norway have set targets for 2030 and 2025, respectively. Considering Europe's high rate of vehicle ownership, if the ICE phase-out proceeds as planned, the resulting massive demand gap will inevitably create significant growth opportunities for upstream and downstream companies in China's new energy industry chain.

Europe and Southeast Asia Emerge as Top Destinations

Data from the China Passenger Car Association (CPCA) shows that in May, exports of new energy passenger vehicles reached 92,000 units, a year-on-year increase of 135.7% and a month-on-month rise of 1.2%.

China's rapidly growing electric vehicle exports are fueling a new wave of overseas expansion for its battery industry. The long-term international footprint of Chinese battery companies is also providing crucial support for Chinese automakers venturing abroad.

Intensifying domestic competition is pushing Chinese EV manufacturers to accelerate their global expansion, with Europe and Southeast Asia emerging as preferred markets. Taking Southeast Asia as an example, its extremely low electric vehicle penetration rate of just 1%, combined with a population of nearly 700 million, makes it highly attractive.

After targeting North America and establishing facilities in Germany and Hungary, CATL, the world's leading battery manufacturer, has now directly entered Southeast Asia. On June 8, CATL announced a CTP (Cell-to-Pack) cooperation agreement with Thailand's Arun Plus, under which CATL will provide and share its CTP battery pack production lines and technology. This partnership marks a crucial step in CATL's strategy to strengthen its global presence.

Coincidentally, Eve Energy, which has a partnership with BMW, is also pushing into the Southeast Asian market. It is reported that Eve Malaysia, a wholly-owned subsidiary of Eve Energy, signed a memorandum of understanding with PKL to purchase target land for establishing a lithium battery manufacturing plant in Malaysia. Meanwhile, Eve Hungary, another wholly-owned subsidiary, has signed a land purchase agreement with a company under the Debrecen municipal government in Hungary to acquire land in the city's northwest industrial zone for the production of cylindrical power batteries.

"Building the Eve Energy factory in Malaysia will further expand our production capacity, align with industry trends, and is crucial for advancing our internationalization," said Liu Jincheng, Chairman of Eve Energy. "In the future, we will build a new factory in Europe for BMW and aim to become one of the primary battery suppliers for European automakers."

Having grown significantly through the acquisition of AESC from the Nissan Group, Envision Power—already with extensive overseas operations—recently established a new lithium battery factory near the French city of Douai, which will begin supplying Renault as early as the beginning of 2025. At the same time, XTC New Energy plans to establish a joint venture with France’s Orano in Dunkirk, northern France, with an estimated investment of approximately 1.5 billion euros (about 11.3 billion RMB).

In addition, Putailai plans to build a 100,000-ton integrated R&D and production base for lithium-ion anode materials in Södertälje, Sweden; Sunwoda has established a subsidiary in Vietnam to manufacture lithium batteries for smartphones, laptops, and other devices; and Longpan Technology intends to develop, through its subsidiary, a large-scale production project for cathode materials of new energy vehicle power and energy storage batteries in Indonesia.

"By 2025, there will be approximately 400 GWh of capacity gap in overseas markets," said Zhao Weijun, Executive Director and President of China Region at Envision Power. "The automotive industry's demand for local production means that whoever can meet this demand and successfully go global will gain a strategic advantage."

Growing Global Influence

Chinese battery companies are gaining increasing influence in the global new energy industry, a trend clearly reflected in industrial investments and market share. According to incomplete statistics from the Securities Daily, since 2022, more than 125 investment projects exceeding 100 million yuan have been announced by over 50 domestic battery companies, with total planned investments surpassing 1.4 trillion yuan and total capacity planning exceeding 2,500 GWh.

In terms of market share, six of the world's top 10 power battery manufacturers in 2022 were Chinese. The latest data shows that from January to April this year, CATL and BYD ranked first and second globally with market shares of 35.9% and 16.1%, respectively, while CALB, Gotion High-tech, Eve Energy, and Sunwoda ranked 6th, 8th, 9th, and 10th, respectively.

On this, Su Bo, Chairman of the National Expert Committee on Intelligent Manufacturing, stated, "To consolidate and enhance China's leading international position in the new energy vehicle and power battery industries, we must continuously improve the market environment, reduce blind investment in new projects, avoid vicious and excessive competition, and prevent overcapacity and resource waste."

Besides the hidden risk of overcapacity, policies such as the U.S. Inflation Reduction Act, Canada’s Investment Act, the European Critical Raw Materials Act, and the EU Battery and Waste Battery Regulation are also creating obstacles for Chinese battery companies expanding into overseas markets.

For example, the EU Battery and Waste Battery Regulation explicitly requires that after 2027, new energy vehicles cannot be sold in the EU if their battery carbon footprint fails to meet threshold requirements. Similarly, the U.S. Inflation Reduction Act mandates that a certain percentage of critical battery materials in electric vehicles must be extracted or processed in the U.S. or in countries with free trade agreements with the U.S.

In Gao Yunpeng's view, carbon footprint management for power batteries will become a key factor for Chinese battery manufacturers to enhance their global competitiveness. The top priority now is to accelerate the establishment of a domestic power battery carbon footprint standard system and proactively align it with international standards to achieve mutual recognition. At the same time, it is also necessary to comprehensively build a competitive, compliant supply chain for critical upstream raw materials that meets regulatory requirements, support the development of localized supply chains, and engage in healthy competition with local enterprises.

Moreover, automotive parts companies going global should follow the future market deployment strategies of automakers. "Currently, most automakers plan to focus on major European markets such as Germany and France, as well as parts of North America, over the next three to five years," said Gao Yunpeng. He believes that the aforementioned countries and regions offer more favorable industrial and market demand conditions, along with advantageous tariff policies. Parts suppliers, especially lithium battery companies, should closely follow automakers' overseas expansions and play their due role in supporting the globalization of China's automotive industry.

文章来源:证券日报网